rhode island income tax payment

You must pay estimated income tax if you are self employed. Web Rhode Island Income Tax Range.

How Do State And Local Sales Taxes Work Tax Policy Center

Each tax bracket corresponds to an income range.

. Web State of Rhode Island Credit Card Tax Payment Division of Taxation. Effective July 11 2022 this site will be deactivated and users will no longer be able to. RI-1040V - Rhode Island Tax.

Web Rhode Island Income Tax Calculator 2021. 2023 2022 2021 2020. Web Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax.

Web In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Web The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. You will be notified of the fee amount before making your payment.

Web The fee is the total of 2 of the tax amount paid plus a 100 transaction fee. Rhode Island Municipalities Contact Info. Web Rhode Island income tax rate.

599 on taxable income over 155050 Rhode Island Taxation of. Web Please contact your local tax collector for specific information about any local business-related taxes you may owe. Customize using your filing status deductions exemptions and more.

Web Brief summary of Rhode Island state income tax. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Web In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children.

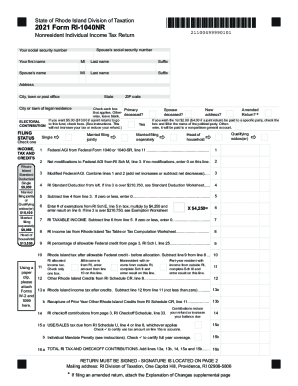

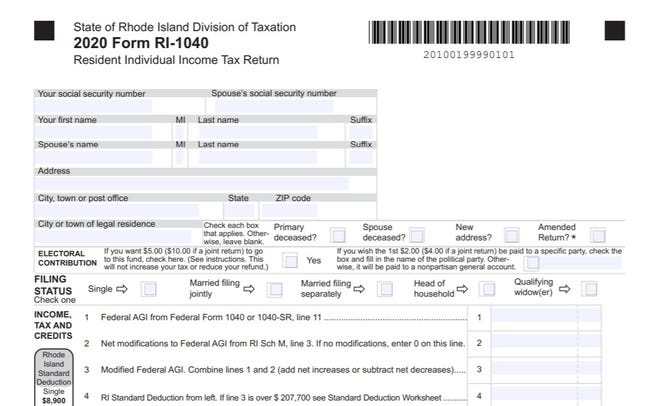

Residents and nonresidents including. Web Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599. Web Form 1065V is a Rhode Island Corporate Income Tax form.

Web Rhode Island State Income Tax Forms for Tax Year 2022 Jan. Filing for tax year. 31 2022 can be e-Filed in conjunction with a IRS Income Tax Return.

Your average tax rate is 1198 and your. Web Please contact your local tax collector for specific information about any local business-related taxes you may owe. Census Bureau Number of cities that have local income taxes.

Web Income Tax Voucher. Web The Rhode Island Division of Taxation has a new web portal httpstaxportalrigov. Social Security number.

Web In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum. Web In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum. Division of Taxation Web site RIgov.

Web Find out how much youll pay in Rhode Island state income taxes given your annual income. 375 on up to 68200 of taxable income High. Subject to Disability Insurance SDI of 13 up to 74000.

The Rhode Island Division of. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the. The range where your.

State income tax rate ranges from 375 to 599. Rhode Island Municipalities Contact Info.

Rhodeislandtax Rhodeislandtax Twitter

Rhode Island State Tax Software Preparation And E File On Freetaxusa

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

Riddc It S Tax Time Tax Credit Information And Also Free Tax Preparation Service Is Available To See A List Of The 2021 Vita Sites In Rhode Island Click This Link Http Www Economicprogressri Org Index Php Volunteer Income Tax Assistance Vita

Nearly 115 000 Rhode Island Families Expected To Receive Child Tax Credit Payments Abc6

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent

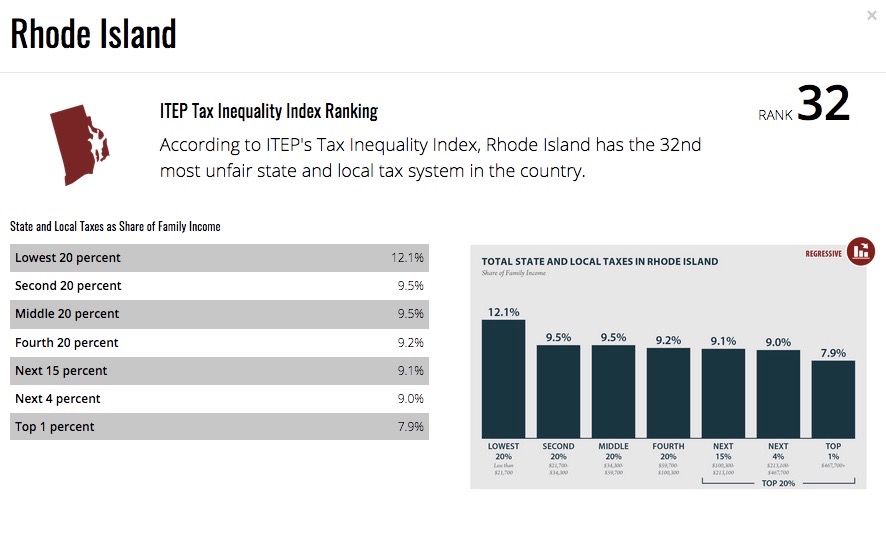

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Rhode Island Income Tax The Decline Of The Ocean State How Money Walks How 2 Trillion Moved Between The States A Book By Travis H Brown

Rhode Island State Tax Guide Kiplinger

Rhode Island State Tax Software Preparation And E File On Freetaxusa

Rhode Island Income Tax Rates Fill Out And Sign Printable Pdf Template Signnow

Rhode Island Form 1040es 1040 Estimated Tax Return With Instructions 2021 Rhode Island Taxformfinder

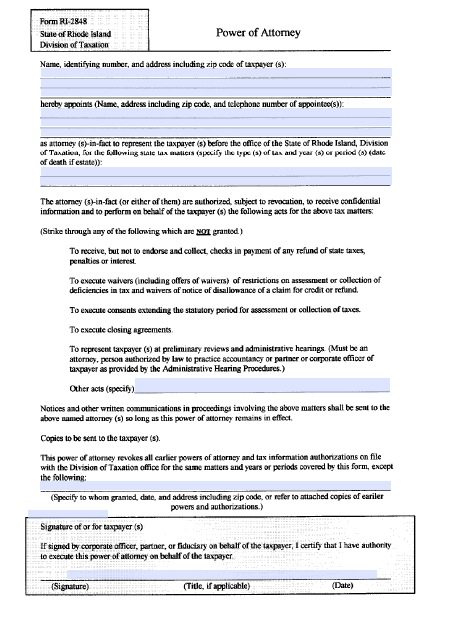

Free Tax Power Of Attorney Rhode Island Form Pdf

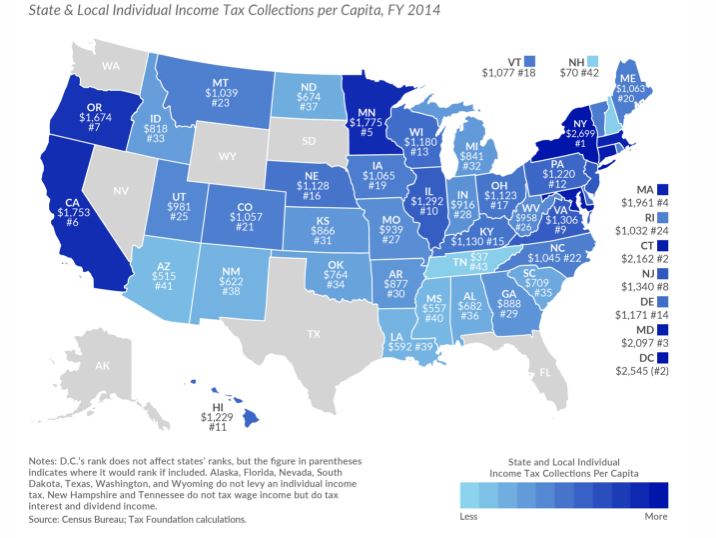

R I State And Local Income Tax Per Capita 2nd Lowest In New England

Rhode Island Division Of Taxation 2018 Filing Season Presentation Ppt Download

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Some Tax Returns Payments Due Thursday In Rhode Island Wjar

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation